What to invest in

In this article, I will tell you what to invest in. It won’t be detailed, but it will be digestible. This absolutely is investment advice, because the three portfolios I’m going to recommend are relatively safe long-term bets. We’ll cover the 100% stocks portfolio, the 60/40 portfolio, and finally the All Weather portfolio.

100% stocks

This is a simple portfolio consisting only of stocks. What stocks, you ask? Well, I can recommend broad index funds such as the S&P 500, which contains the five hundred biggest companies in the US. It has Apple, Google, Coca-Cola, and many others. Some people might tell you that the S&P 500 is too heavily concentrated in one country. And although they’re right, the world has gotten more globalized and today roughly 40% of these companies’ revenues come from other countries. But if you want true international diversification, which is probably wiser anyway, then check out the MSCI All World ETF. Make sure to pay attention to the fees, the lower the better.

Pros: Will do well over long term (multiple decades)

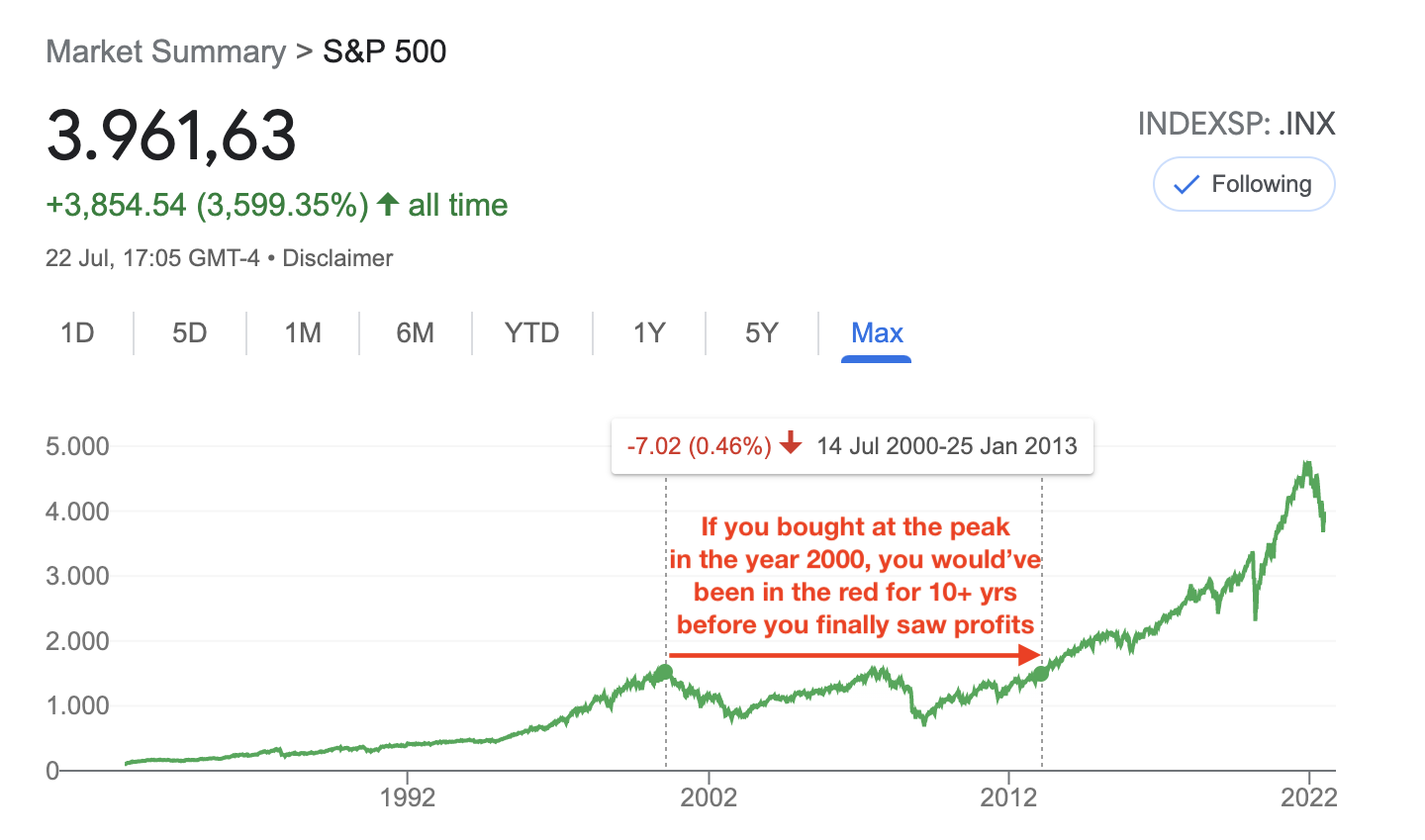

Cons: Painful drawdowns: stocks can crash by 50%, and it might take a decade or more to recover.

From the year 2000 until 2012, the S&P 500 suffered a “lost decade”, meaning that it was down and didn’t make any money 🤦🏽♂️.

Lesson: Stocks don’t always go up. They can go down or sideways for many years. The US stock market has had several of such “lost decades”. Imagine how painful it’d be if you invested at the peak, and only saw your portfolio lose value for the next 10 years. So with that in mind, wouldn’t it be great if we could protect ourselves from such a drawdown, and keep making money even during a lost decade? Keep reading because I got just the right porfolio for you.

The 60/40 portfolio

This portfolio consists of 60% stocks and 40% bonds, rebalanced quarterly. The peak of the dot-com bubble (the year 2000) was one of the worst entry points in history for US stocks. But the 60/40 portfolio still delivered ~6% per year. I think this is amazing.

For the stock allocation, you could go with the S&P 500 or MSCI World. Now the 40% bonds part: I recommend US Treasury bonds, preferably with a long duration (of 20 years or longer). Why? Well, often, when stocks go down, bonds go up. And the bonds that have a longer duration, like 20+ years, go up even more. This reduces long and steep drawdowns and keeps your portfolio more balanced.

Simple example: Stocks can drop 50%, or even more. Even worse; they stay that low for years. Imagine if you had put $100K in only stocks, with no bonds. And you saw half your portfolio evaporate. Damn, that’s painful. Many investors cannot take that (psychologically), and they sell near the bottom. Which is the worst mistake one could make.

To prevent such human errors, bonds are very useful. They reduce volatility in your portfolio. If stocks drop 50% (and it will surely happen), your portfolio will be somewhat intact due to your bond allocation. Now the bonds won’t go up with exactly the amount that stocks went down. In other words; you’ll still suffer a temporary drawdown. But you’ll be much better off than your neighbor who is 100% invested in stocks. Meanwhile, you’re chiling and enjoying life. Because of your bonds.

Now one important thing about bonds is this: A lot of people will tell you that you are stupid for buying bonds, because they don’t yield anything anymore. They will use believable stories to try to convince you. But you should not listen to them. They are retarded. Bonds go up and down over time, and they serve a valuable function, even during times at which the interest rate are low (when bonds don’t pay you a lot).

Having said that, during a period with high inflation, interest rates could rise, which would bring down all asset prices, including those bonds which were meant to protect you during a drawdown. We will cover this in the next part of the article. So the 60/40 portfolio isn’t “perfect” and doesn’t always work as intended. Still, a 60/40 portfolio will do very well over long periods of time with smaller drawdowns

Pros: Less volatility than 100% stocks, you’ll probably be up each year

Cons: A 100% stocks portfolio will probably outperform over long timeframes of multiple decades (assuming zero human interference)

All Weather portfolio

There are some rare circumstances in which both stocks and bonds fall in lockstep. When does this happen? Well, it can happen during an inflationary period. That’s when prices of consumer goods are rising. To combat rising prices, the central bank can increase interest rates. Higher interest rates work like gravity; they bring all asset prices down. That includes stocks, bonds, real estate, and practically everything else.

But, there is one asset class that will go up a lot, especially during an inflationary period where higher interest rates drag down everything else. That asset class is.. *drumroll* .. Commodities. Commodities are raw materials used as input to produce (more useful) final goods. Think of wheat, iron, copper, and other stuff that factories need to produce the shit we end up buying. So by simply adding commodities into our portfolio, we could partly protect ourselves from suffering drawdowns during an inflationary period. Mind you that our stocks and bonds would still decline, but our commodity allocation would rise and partly make up for it. Just add 7.5% commodities and rebalance quarterly.

Now, you might ask, why doesn’t everyone always include commodities in their portfolio? Good question. That’s because commodities generally lose money. Remember that they are quite literally commodities. Including commodities reduces your overall profit in the end, but it also reduces the drawdowns during your decades-long investment journey in which you might suffer one or two inflationary periods. And that will help you achieve the goal of sticking to the strategy and to stay invested. It reduces the chance of human error, just like bonds do in the 60/40 portfolio.

Finally, we’ll also add 7.5% gold. Why gold? Currencies can crash. Even the major ones that you think won’t crash during your lifetime, could crash at some point. Gold is an asset class that more or less keeps its value over long periods of time, regardless of the currency it’s denominated in.

The key point about the All-Weather portfolio is that the commodities and gold serve as a hedge, which is just a fancy term for insurance. And insurance costs a little bit of money. But also allows you to sleep better knowing certain things are insured.

Pros: does well in all climates

Cons: will likely underperform the 60/40 and 100% stocks portfolio over long timeframes

Conclusion

When people ask me what to invest in, these are the only three things I can truly recommend to my beloved friends and family. Surely, some people made it big betting the farm on Tesla stock, or in some random shitcoin. But you only hear of the winners. These three portfolios are what’s been making a lot of regular people a fuckton of money. They are effective and foolproof.

If this article helped you, feel free to share it with your friends.

October 11, 2022

I like your advice, kindly share with me with companies allow Africans to invest in whether in US or in International markets.