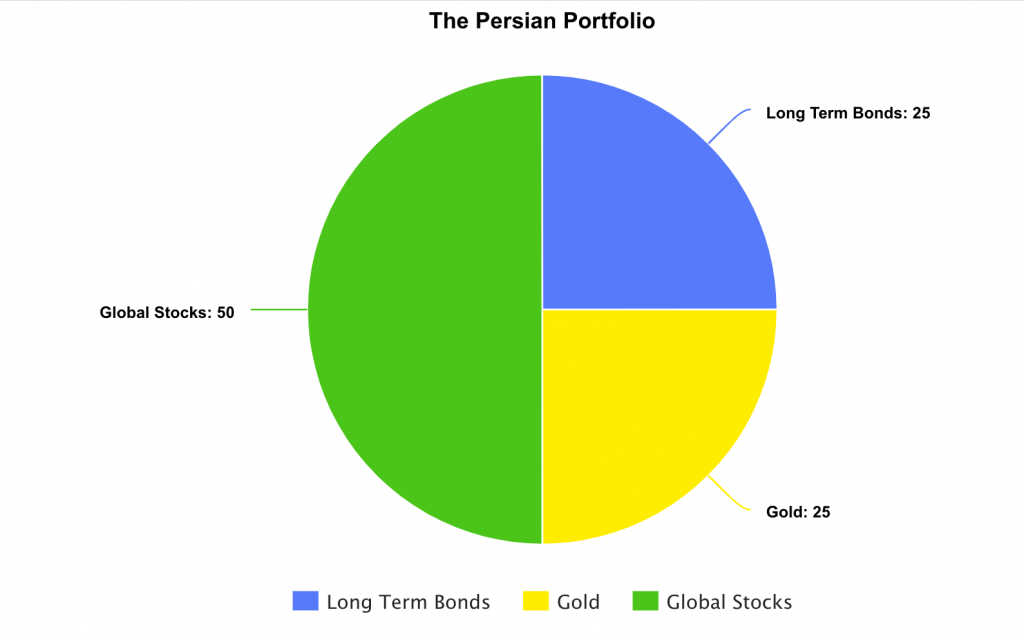

The Persian Portfolio

Executive summary: If you have excess savings that you want to grow and compound with minimum drawdowns, you should put half of it in global stocks, a quarter in bonds, and the last quarter in gold. Rebalance yearly and go to the beach.

The Persian Portfolio is an investment portfolio that consists of just three assets:

– 50% Global Stocks

– 25% Long Term Treasury Bonds

– 25% Gold

It’s simple because it’s just three assets, and also robust because it can withstand catastrophes with very little drawdowns. The vast majority of my savings are in this portfolio.

A smooth ride up

While normal people are afraid of heights or spiders, I am afraid of “lost decades”, which refers to a timeframe of ten years in which stocks only went down or sideways. The last lost decade for the S&P 500 was from the year 2000 until 2012. Imagine investing in stocks during the turn of the millenium ,and then checking your portfolio and it just goes deeper into the red, week after week, month after month, year after year. It’s mentally difficult to stay invested in a portfolio that’s not performing well. The good news is that when stocks go down there are always other assets that go up (usually bonds or gold). For this reason, it’s a good idea to diversify across asset classes. The ride upwards will be much smoother, with minimal drawdowns. This allows investors to sleep well and focus their attention on more interesting things in their life.

Okay I’m convinced. Which stock tickers should I buy?

I recommend VT, TLT, and IAU.

Credit: This portfolio is heavily inspired by @ValueStockGeek.

January 16, 2024

Leave a Reply